Public finance law is a crucial aspect of modern societies, governing the management, allocation, and utilization of public funds. This legal framework plays a vital role in maintaining fiscal discipline, promoting transparency, and ensuring the efficient use of taxpayer money. In this comprehensive article, we will delve into the intricacies of public finance law, exploring its key principles, functions, and impact on the public sector.

Table of Contents

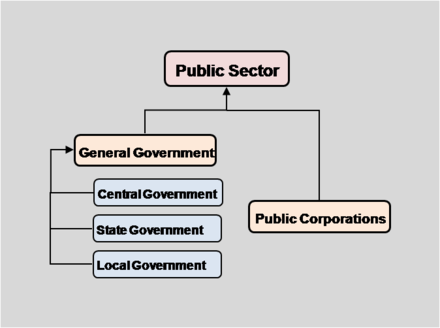

Understanding Public Finance in Law

Public finance law refers to the set of regulations and rules that guide the financial activities of governments at various levels—national, state, or local. Its primary goal is to oversee the collection, allocation, and expenditure of public funds to ensure the well-being of citizens and the smooth functioning of public services. This legal framework encompasses a wide range of areas, including budgeting, taxation, borrowing, procurement, and public debt management.

The Foundation of Public Finance Law

The foundation of public finance in law lies in the principles of accountability, equity, and efficiency. Governments must be accountable for their financial decisions, ensuring transparency and responsiveness to the needs of the public. Equity involves distributing resources fairly, with a focus on reducing socioeconomic disparities. Lastly, efficiency calls for optimizing resource allocation to achieve the maximum benefit for society.

Key Components of Public Finance Law

- Budgeting and Financial Planning: A fundamental aspect of public finance in law involves creating budgets and financial plans that outline government revenue sources, expenditures, and fiscal targets. Proper budgeting enables policymakers to allocate resources effectively and address the needs of various sectors.

- Taxation and Revenue Generation: Taxation is a critical element of public finance, providing the government with the necessary revenue to fund public services and infrastructure development. Public finance law governs tax policies, rates, and collection methods.

- Public Debt Management: Governments often resort to borrowing to finance projects beyond their immediate means. Public finance law oversees debt issuance, repayment, and management to prevent unsustainable levels of debt.

- Procurement and Contracting: Public finance law regulates the procurement process to ensure transparency, fair competition, and accountability in government contracts and purchases.

- Financial Reporting and Auditing: Transparency is key to public finance management. Proper financial reporting and independent auditing help maintain accountability and identify potential financial irregularities.

The Role of Public Finance Law in Economic Stability

Public finance in law plays a vital role in maintaining economic stability. By establishing sound fiscal policies, governments can control inflation, manage unemployment, and encourage economic growth. Public finance law also influences investment decisions, as it provides clarity and predictability to investors regarding tax policies, government spending, and fiscal discipline.

Impact on Public Sector and Services

Efficient public finance in law directly affects the quality of public services. Adequate funding enables the government to improve healthcare, education, infrastructure, and social welfare programs. It ensures that essential services reach those in need and contribute to overall societal development. Additionally, public finance law promotes accountable and transparent governance, reducing the likelihood of financial mismanagement or corruption.

Public finance law is a vital legal framework governing the management, allocation, and utilization of public funds at various governmental levels. This comprehensive system ensures transparency, accountability, and efficiency in handling taxpayer money. Public finance in law covers essential aspects such as budgeting, taxation, public debt management, procurement, and financial reporting. By adhering to its principles and ongoing reforms, governments can maintain economic stability, promote equitable growth, and deliver high-quality public services that positively impact the lives of their citizens.

Challenges and Reforms in Public Finance Law

Despite its significance, public finance law faces several challenges. Fiscal deficits, increasing public debt, and complex financial systems pose hurdles to effective fiscal management. However, ongoing reforms aim to address these issues and strengthen the legal framework.

- Fiscal Responsibility and Budget Discipline: Governments must adopt measures to maintain fiscal discipline and avoid excessive borrowing, ensuring long-term financial sustainability.

- Tax Reforms for Equitable Growth: Progressive taxation policies can help reduce income inequality and ensure that the burden of taxation is distributed fairly.

- Technology and Financial Management: Utilizing advanced technologies for financial management can improve efficiency, transparency, and accuracy in financial transactions and reporting.

Conclusion

In conclusion, public finance law forms the backbone of a well-functioning public sector, shaping economic stability, social development, and accountable governance. It encompasses various crucial components such as budgeting, taxation, debt management, procurement, and financial reporting. Adherence to the principles of accountability, equity, and efficiency is essential for effective public finance management.

Governments must continuously strive to reform and adapt public finance laws to address evolving challenges and promote sustainable economic growth. By doing so, societies can ensure that public funds are utilized optimally to benefit citizens and foster the collective progress of the nation. Public finance law’s impact on the public sector cannot be understated, as it directly influences the quality of public services and the overall well-being of the population. Through robust and well-optimized public finance law, nations can pave the way for a prosperous and inclusive future.

Learn about: Navigate corporate finance confidently! Explore the legal backbone: principles of corporate finance law and excel in business compliance.